Or Call 01 437 8559

Get instant access

Plus receive unlimited tutor support via phone & email from experienced professionals.

Study at your own pace – students generally complete one module per-week. See our free course guide for detailed duration information.

Advance your accounting career

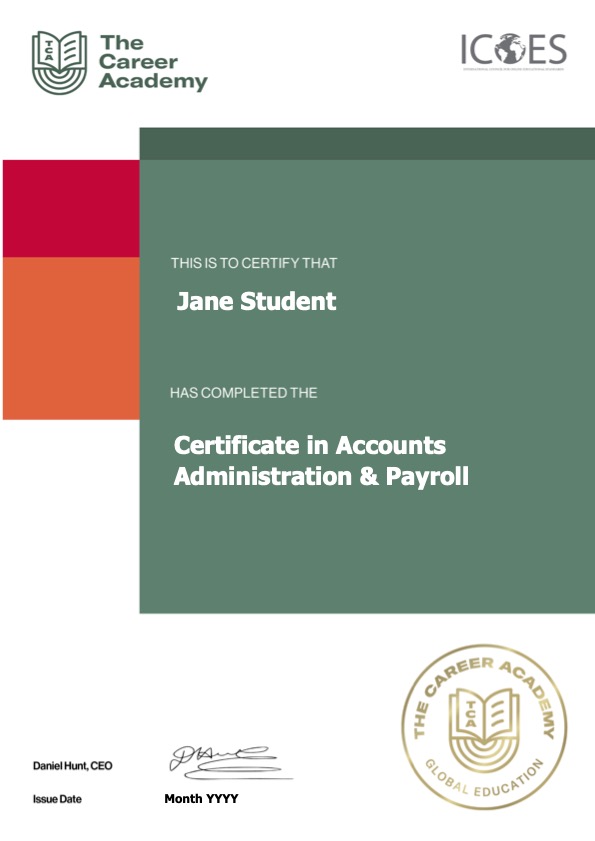

Be awarded with an industry-recognised certificate of achievement on completion of this course.

Almost immediately, it was the AAT Accounting Technician Pathway Program that caught her eye. ‘It offered me the accounting theory that I needed, with the option to add “Accounting Technician” status to my name, along with applying all my theoretical knowledge into practice through the use of accounting software such as Xero. It was also a lot more value for money than other courses I had researched.‘

This qualification comprises two components:

POPULAR

Pay your course fees upfront and benefit from a €349 discount, with a 7 day money-back guarantee.

We’re an internationally recognised online education provider, who partners with industry to deliver you the latest and most up to date content. We have over 15 years experience in online education and help change the lives of over 20,000 students every single year.

Our professional tutors at The Career Academy are industry experts who are passionate about helping students succeed. They’re committed to providing exceptional online course support and personal tutoring to help you succeed. Throughout your course, you’ll receive unlimited tutor support via phone and email.

Stephanie completed her Bachelor of Business (Marketing/Event Management) from La Trobe University in Melbourne. Before joining The Career Academy, Stephanie received 5+ years of Reception and Administration experience, with a working knowledge of Microsoft Office and administrative skills. With her experience and expertise, Stephanie started her journey as an Administration, Management, and MS tutor at The Career Academy. As an educator, Stephanie is passionate about assisting each of her students to reach their full potential and seeing her students achieve their career goals and new opportunities.

Kelly graduated with a Bachelor of Arts major in Teaching English to Speakers of Other Languages (TESOL), and a minor in Linguistics and Chinese at Victoria University of Wellington. She engages well with students from different age groups, backgrounds, and cultures. Her past experiences in working with students involved being a junior class mentor in College, a campus coach/student ambassador at University, participating in cultural clubs, and teaching dance (which is one of her hobbies!)

Kelly has joined The Career Academy in 2020 as a tutor to build her career and experiences. She confidently says this: “I am grateful to be a part of a positive company with core values that I align with. It is amazing to get to interact with a variety of students. Being a tutor for me is not just about getting the work done, but ensuring that I do my best to help someone – whether it may be easy or difficult. At the end of my day, it makes me happy knowing that I have helped a student.”

Amoré is an Administration, Management & Microsoft Office tutor who works with The Career Academy to help students achieve their career goals. Amoré has a Bachelor of Arts Degree specialising in Psychology, English and a Certificate in Language Teaching (CELTA), along with many years of working within the administration and education field. These qualifications coupled with years of experience in various industries enables Amoré to provide the best education experience for her students.

When Amoré isn’t helping students to achieve the very best out of their studies, she enjoys travelling with friends , yoga, and creating artwork in her free time.

Nick works as an Administration, Management, and MS Office Tutor, coming from a background of studying Criminology and Sociology at Monash University. This was followed by years of experience in Administration roles based in many departments across an array of industries. With a passion for helping people, Nick has come to The Career Academy with a mindset to use his experience in these roles to help make a difference for students, assisting them on their road to upskilling towards a new role or career, and reaching their goals.

In his spare time, Nick can be found cheering on one of his many sports teams, at the gym, watching films, hiking and singing Motown songs while cooking.

Career Opportunities

Graduates of The Career Academy’s Administration program frequently find employment with healthcare providers and within small to medium-sized businesses across Ireland. Our team is committed to ensuring that you are thoroughly prepared for your career. As a result, upon graduation, you can anticipate qualifying for job titles such as:

Career Projections

It is anticipated that Ireland’s administrative and business services job sector will continue to grow at a steady rate of 3.1% over the next five years, mirroring the growth pattern observed in the past five years. This will result in:

Sources: Morgan McKinley, National Skills Bulletin

The Career Academy is committed to helping you on your pathway to success. We believe by utilising The Career Centre’s resources and connections, you’ll gain confidence and the networks you need to get a new job or promotion.

Once enrolled with us, you will get instant access to our Career Centre and benefit from:

Hannah was in her final year of high school, and like many of us, struggling to figure out what she wanted to do with her future. ‘I was working part-time at a restaurant and was extremely lost with what I wanted to do.’ She says.

Hannah discovered The Career Academy through the recommendation of a friend and decided to enrol. ‘I chose The Career Academy because the wide variety of courses they have to offer was extremely appealing and exactly what I was looking for.’ It wasn’t just the range of choices that appealed to Hannah – studying online meant that she was able to be in control of her study rather than her schedule being dictated by a fixed timetable.

‘I also liked the structure and flexibility the courses provided, the level of independence the courses allowed was something I really enjoyed about TCA. It meant I was able to work on my time management skills and be in control of my schedule. I liked how well the course was outlined and that it was easy to understand. Another plus was the use of forums, as this meant I could engage with other students.’

The flexibility that The Career Academy offered also meant that Hannah was able to continue working throughout her studies. ‘Studying at The Career Academy meant I was able to balance work and study well. At the time, I was waitressing at night and on the weekend, but The Career Academy’s course structure meant I could study at times that suited my schedule best.’

It didn’t take long after completing her course for Hannah to land a new job. ‘I was given the opportunity to work as a sales administrator for a local packaging company. The knowledge gained from my course has certainly helped in my sales administration role. It gave me a great insight into the administration world, and helped make the transition into this role extremely smooth.’

Hannah’s journey is far from over, and she’s now decided to enrol in a Bachelor of Business to continue her career journey. ‘Completing my course with The Career Academy straight out of school was one of the best decisions I could have made. It was such a good start to my career and really helped me find what I was passionate about.’

Hannah studied the Certificate in Reception & Office Support – a comprehensive 10-week course designed to give you the skills to kickstart your reception career including effective business communication, customer service, health and safety, and an introduction to Microsoft Word.

There are no entry requirements or prerequisites to enrol on this course. You can enrol online directly by clicking on “Enrol Now” and following the prompts.

Alternatively, you can enrol over the phone with our friendly student advisors – call 01 437 8559 or email info@careeracademy.ie

This course costs €1,250.00 or only €25 per week on a no-deposit, interest-free payment plan. Click here to get started now.

This course takes approximately 400 hours, and you’ll have up to 18 months to complete. Study in your own time, at your own pace. Most of The Career Academy courses are designed so that you do one module a week, but if life gets busy, you can apply for a course extension if you need more time.

Upon completing this course, you could obtain work as an Office Administrator or Payroll Specialist.

Contact a friendly student advisor on 01 437 8559 to learn about potential career outcomes and where our courses could take you. You’ll also receive a FREE CV review.

Your course is delivered through our online learning platform, which you can access from any web browser 24/7 to work whenever and wherever you want. You can also interact with your tutors and other students within the learning environment. Online learning allows you to make the best use of your time and puts all the necessary resources at your fingertips. There are no set course start dates; you can start whenever you are ready, and your tutors and student services will check in on your progress and help you every step of the way.

Watch this video to see how online learning works:

Absolutely! You’ve got a 14-day cooling-off period (trial period) at the start of your course. Take that time to review all your learning material and get a feel for online learning. If you decide the course isn’t for you within the trial period, you’ll get a full money-back guarantee*.

These are two similar designations, both widely known in the accounting industry.

Absolutely! Students who have complete this Program, including the CAT certification component with IPA, will also be eligible for 3 exemptions from the ACCA Qualification:

©2023 The Career Academy is Internationally Approved and Registered with the International Approval and Registration Centre. We are an ICOES accredited centre and all the programs we offer are therefore accredited. The Career Academy is a Xero Partner, an MYOB Approved Education Partner, an IAB Accredited Training Provider and an AAT Approved Training Provider(Provider code: OO01000627).